Today you are about to find out that even the most experienced trader can still mess up. I've always been honest on this blog about how I'm faring and as the first day of the month has traditionally become my monthly P&L day, I shall continue onwards but head bowed low for the first time in a long time. The bad news: the first week of the US Open has been my worst EVER week of trading, profit wise. I've spurned literally thousands of pounds in just a few days. The good news: I'm still in profit!

Until a week ago, August was actually my most successful month ever as a trader. I will whisper it quietly, but I was actually in sight of my first 5 figure monthly total. But maybe that was the problem: the whispers became too loud! With an entire week of Grand Slam tennis to end the month, I started to focus on hitting that £10,000 mark. This is an old habit that I thought had died a couple of years ago, fixating on specific financial targets. But somehow, it returned and I couldn't let go. I got over-excited and over-confident. The first week of Wimbledon was my most profitable week of trading (and still is!) and I knew that if I replicated that for the US Open, I would possibly hit a figure that I could only have dreamed of a year ago. I had it in my mind that if I could make a 5 figure sum in one month, that I had truly "arrived" and could consider myself a successful, accomplished, professional trader. It was the icing on the cake, so to speak. For me, it would have been the final, ultimate triumph of my journey from consistent loser to consistent winner - and I desperately wanted to get it. TOO desperately, as it turned out. Things plodded along for the first 2 days and I was breaking even pretty much but then a few trades which were executed perfectly in line with my strategy, didn't come off and I started to worry; only a few days left and it was looking like I wouldn't hit my target.

So I forced a bet, to try and get things rolling. It went horribly wrong and I lost my entire stake. I also lost my head. Although that turned out to my largest loss, it still didn't make a huge dent in my month's tally. But I didn't focus on the good work from the previous 20+ days. I was only focusing on that 10k mark. Next came a series of losses that equates to my worst ever sequence: 22 losses in a row (not including 4 greens which were all under £10). And they were pretty much all big losses. The question I always ask in this situation is: how much of it was down to variance and how much was me on tilt? This is a question that any trader must be able to answer honestly because if you can't, you will never be able to adjust and improve. These days, I know exactly each and every trade whether it was executed properly and what I should have made on each one compared to what I actually made. My honest assessment is that even if I hadn't gone on tilt and started chasing, I still would've had a lot of losses. It was just one of those weeks where very little went my way. There were an unusually high number of very one-sided matches where during an average week, I would have had at least a handful of them turn in my favour. This week, hardly any of them did. And that is bad variance in a nutshell. It's frustrating but has to be expected and planned for. It's why I have a large bank of money the majority of which just sits there, untouched. This month however, I didn't need that bank to cushion the blow as I'd already had a fantastic month of profit. But as I sit here staring at that profit (less than half of my total for the previous 2 months), I can't help but feel gutted. Yet if you'd told me a year ago that I would be pissed off at making £2000 in one month, I would've laughed in your face! So I have to put things into perspective and move on.

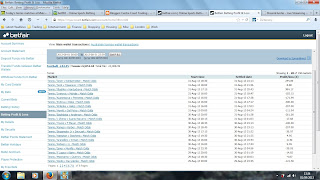

What this last week has shown, is that you can never let your guard down in this game. I've always maintained that trading is a mental game above all else and is a constant battle to stay on the emotional tightrope. I'm fortunate in a way, that this period of variance did not happen at the start of August, which would have decimated my bank. But then again, would it have even happened at the start? I wasn't focused on making 10k on August 1st, not at all. I have spells of bad variance every month, so it's not like it was anything new. My bank is the size it is because I know that it should withstand a nasty spell like this. It was only because I saw that 5 figure sum on the horizon and a Grand Slam event to help chase it, that affected my mind and my trading. I worked out that if I had traded properly, without chasing, just the bad variance, I would've roughly saved 50% of my losses and that would've given me a monthly total similar to what I'd achieved last month. I would've had a few wins amongst those 22 losses too, as by entering the market at incorrect moments, I often ended up ruining the chance for me to later enter when I should have done, for profit. I also found myself getting more timid. You will see 2 good wins right at the end of the month on the P&L. The largest one looks pretty tidy but in fact, I was so timid that I only went in with half my usual stake: Hantuchova should actually have netted me almost £800 on that trade. The Kohlschreiber win should also have been almost double the amount.

So anyway, no real harm done and in retrospect, it does show just how far I've come. A year ago, I was happy to make £500 on the tennis. Now, 4 times that amount constitutes failure. Trading, eh?

Camila Giorgi:

Until a week ago, August was actually my most successful month ever as a trader. I will whisper it quietly, but I was actually in sight of my first 5 figure monthly total. But maybe that was the problem: the whispers became too loud! With an entire week of Grand Slam tennis to end the month, I started to focus on hitting that £10,000 mark. This is an old habit that I thought had died a couple of years ago, fixating on specific financial targets. But somehow, it returned and I couldn't let go. I got over-excited and over-confident. The first week of Wimbledon was my most profitable week of trading (and still is!) and I knew that if I replicated that for the US Open, I would possibly hit a figure that I could only have dreamed of a year ago. I had it in my mind that if I could make a 5 figure sum in one month, that I had truly "arrived" and could consider myself a successful, accomplished, professional trader. It was the icing on the cake, so to speak. For me, it would have been the final, ultimate triumph of my journey from consistent loser to consistent winner - and I desperately wanted to get it. TOO desperately, as it turned out. Things plodded along for the first 2 days and I was breaking even pretty much but then a few trades which were executed perfectly in line with my strategy, didn't come off and I started to worry; only a few days left and it was looking like I wouldn't hit my target.

So I forced a bet, to try and get things rolling. It went horribly wrong and I lost my entire stake. I also lost my head. Although that turned out to my largest loss, it still didn't make a huge dent in my month's tally. But I didn't focus on the good work from the previous 20+ days. I was only focusing on that 10k mark. Next came a series of losses that equates to my worst ever sequence: 22 losses in a row (not including 4 greens which were all under £10). And they were pretty much all big losses. The question I always ask in this situation is: how much of it was down to variance and how much was me on tilt? This is a question that any trader must be able to answer honestly because if you can't, you will never be able to adjust and improve. These days, I know exactly each and every trade whether it was executed properly and what I should have made on each one compared to what I actually made. My honest assessment is that even if I hadn't gone on tilt and started chasing, I still would've had a lot of losses. It was just one of those weeks where very little went my way. There were an unusually high number of very one-sided matches where during an average week, I would have had at least a handful of them turn in my favour. This week, hardly any of them did. And that is bad variance in a nutshell. It's frustrating but has to be expected and planned for. It's why I have a large bank of money the majority of which just sits there, untouched. This month however, I didn't need that bank to cushion the blow as I'd already had a fantastic month of profit. But as I sit here staring at that profit (less than half of my total for the previous 2 months), I can't help but feel gutted. Yet if you'd told me a year ago that I would be pissed off at making £2000 in one month, I would've laughed in your face! So I have to put things into perspective and move on.

What this last week has shown, is that you can never let your guard down in this game. I've always maintained that trading is a mental game above all else and is a constant battle to stay on the emotional tightrope. I'm fortunate in a way, that this period of variance did not happen at the start of August, which would have decimated my bank. But then again, would it have even happened at the start? I wasn't focused on making 10k on August 1st, not at all. I have spells of bad variance every month, so it's not like it was anything new. My bank is the size it is because I know that it should withstand a nasty spell like this. It was only because I saw that 5 figure sum on the horizon and a Grand Slam event to help chase it, that affected my mind and my trading. I worked out that if I had traded properly, without chasing, just the bad variance, I would've roughly saved 50% of my losses and that would've given me a monthly total similar to what I'd achieved last month. I would've had a few wins amongst those 22 losses too, as by entering the market at incorrect moments, I often ended up ruining the chance for me to later enter when I should have done, for profit. I also found myself getting more timid. You will see 2 good wins right at the end of the month on the P&L. The largest one looks pretty tidy but in fact, I was so timid that I only went in with half my usual stake: Hantuchova should actually have netted me almost £800 on that trade. The Kohlschreiber win should also have been almost double the amount.

So anyway, no real harm done and in retrospect, it does show just how far I've come. A year ago, I was happy to make £500 on the tennis. Now, 4 times that amount constitutes failure. Trading, eh?

Camila Giorgi: